Hi, I'm Jacob.

I'm Founder & CEO of Harveo Group. I help Expats in Poland .

For 16 years, I’ve been diving into challenges and transforming visions into achievements across finance, real estate, management, and leadership.

With a sporty spirit, both in my private life and in business, I always transform obstacles into opportunities, so that I continually develop, come out of them stronger and try to make the impossible possible, which ultimately gives me satisfaction and fuel for further action.

My business approach is quite unique. I believe in work-life balance, fun in daily tasks, and strong team spirit. Driven by open-minded vision and enthusiasm, I inspire those around me. Business is about the thrill of the journey, the joy of creation, and building meaningful relationships. Quality, trust, and connections are my foundation.

Passion fuels success and magic happens when you love what you do!

Harveo Group Brands

References

EXCELLENT Based on 310 reviews

Based on 310 reviews

SennyBoy2024-10-18

SennyBoy2024-10-18Trustindex verifies that the original source of the review is Google.

I had an opportunity to with Seweryn Kobiela regarding my motogage loan. He was very professional and also kind enough to help us in situations where I could not do it myself. He was keeping us updated on everything that was happening and gave good guidance on how to proceed. I highly recommend the services provided by Harveo and Team.

Victoria Trekova2024-10-08

Victoria Trekova2024-10-08Trustindex verifies that the original source of the review is Google.

Chciałem podziękować Harveo, a w szczególności Pana Seweryna. Nasza droga kredytowa była długa z powodu problemów deweloperskich, ale daliśmy radę. Przez cały czas mieliśmy wsparcie, informacje i opiekę. Na pewno poleciłbym go i tę firmę moim znajomym. Jeszcze raz dziękuję!

Neone2024-09-21

Neone2024-09-21Trustindex verifies that the original source of the review is Google.

10/10, polecam kontakt ;) Seweryn ogarnął dobrze

Arkadiusz Michalik2024-09-13

Arkadiusz Michalik2024-09-13Trustindex verifies that the original source of the review is Google.

Chciałbym serdecznie polecić firmę Harveo i ich fantastyczny zespół doradców kredytowych, z którym mieliśmy z żoną przyjemność współpracować już kilkukrotnie. Każdorazowo, kiedy potrzebowaliśmy wsparcia i pomocy w podjęciu decyzji dotyczącej kredytu hipotecznego, doradcy z Harveo stawali na wysokości zadania. Zawsze przedstawiają sytuację jasno i rzetelnie – otwarcie mówią, kiedy warto, a kiedy nie warto brać kredytu, co buduje ogromne zaufanie. Ich fachowość jest nieoceniona, a do tego widać, że robią to z prawdziwą pasją. Zespół doskonale orientuje się w zmieniających się trendach na rynku kredytowym i zawsze dostarcza najlepsze rozwiązania. Jesteśmy przekonani, że będziemy do nich wracać przy każdej kolejnej decyzji finansowej. Dziękujemy za dotychczasową współpracę i z pełnym przekonaniem polecamy każdemu, kto szuka profesjonalnego i godnego zaufania doradcy kredytowego ! Co więcej, są to po prostu wyjątkowi ludzie. Zawsze pełni zrozumienia, nigdy nie wywierają na nikim presji, a każda rozmowa z nimi to czysta przyjemność :)

Tobias Fankhauser2024-09-02

Tobias Fankhauser2024-09-02Trustindex verifies that the original source of the review is Google.

Sehr kompetent und hilfsbereit desweiteren jederzeit erreichbar und motiviert die letzte Meile zu gehen . kann ich nur weiterempfehlen !

Ju2024-08-26

Ju2024-08-26Trustindex verifies that the original source of the review is Google.

Szczerze mogę polecić usługi Harveo, a zwłaszcza Pana Seweryna. Dzięki jego zaangażowaniu, wiedzy, fachowej i miłej obsłudze udało się nam załatwić wszystko bardzo sprawnie i bezstresowo!

Katarzyna Sękul2024-08-17

Katarzyna Sękul2024-08-17Trustindex verifies that the original source of the review is Google.

Bez wahania polecam firmę Harveo i na pewno skorzystam z ich usług za jakiś czas w sprawie refinansowania. Czułam,że powierzyłam moją sprawę ludziom uczciwym, profesjonalnym i...pogodnym! Pan Seweryn wykazał się niezwykłą rzetelnością i nie zrażały go żadne zawiłości. To nam bardzo pomagało zachować spokój w każdym momencie, nieco skomplikowanego w naszym przypadku, procesu zakupu mieszkania na kredyt. Pan Jakub czuwał nad wszystkim i obrazowo tłumaczył zawiłości ekonomiczne. Zdjął sporo stresu z moich pleców opowiadając o możliwości refinansowania. Dzięki bardzo efektywnej komunikacji zdalnej, mogliśmy załatwić sprawy,mimo że byliśmy rodzinnie w rozjazdach. Harveo to dla mnie autentyczni, ciekawi ludzie pracujący etycznie i z pasją. To zupełnie inny standard usług niż ten,z którym się spotykałam dotychczas. Gorąco polecam!

Sebastian Bach2024-08-13

Sebastian Bach2024-08-13Trustindex verifies that the original source of the review is Google.

Serdecznie polecam firmę Harveo. Od pierwszego kontaktu, az po finalizację sprawy wykazali się najwyższym poziomem profesjonalizmu. Doradcy posiadają rozległą wiedzę i potrafią dostosować ofertę do indywidualnych potrzeb. Proces przebiegł bardzo sprawnie i bez komplikacji, a komunikacja była wzorowa. Na każde pytanie otrzymałem odpowiedź i zostały mi wytłumaczone wszelkie zawiłości finansowe. Dzięki nim uzyskanie kredytu było prostsze i znacznie mniej stresujące niż się spodziewałem.

Burak Yürük2024-08-08

Burak Yürük2024-08-08Trustindex verifies that the original source of the review is Google.

I met with Jakub to learn my creditworthiness. He is very knowledgeable on his field and explain everything from the basics which was very helpful for me because I never took a credit in my life. And not only that he shared his opinions about the current real estate/financial markets and how it will move further and also shared very useful tips with me. Hope to continue our relationship with him on the further stages of buying the property.

Michał Gędłek2024-08-05

Michał Gędłek2024-08-05Trustindex verifies that the original source of the review is Google.

Z czystym sumieniem mogę polecić Harveo! Wspólnie działaliśmy nad refinansowaniem kredytu i cały zespół wykazał się pełnym profesjonalizmem, kompetencjami oraz wsparciem w całym procesie, zarówno merytorycznym jak i załatwieniem różnych spraw w moim imieniu, co niewątpliwie jest bardzo dużym plusem i oszczędnością czasu :) Agnieszka, która prowadziła cały proces wykonała naprawdę kawał dobrej roboty! Gratuluję Jakubowi zebrania tak dobrego zespołu i indywidualnego podejścia do klienta! Liczę, że dalsza współpraca również będzie na tym samym poziomie i jak refinans, to tylko z Harveo :)

Services

Individual New Mortgage Plan

I’ll help you find the best mortgage option tailored to your needs. The service is 100% free of charge.

Reduce Your Mortgage %

Lower the high interest rate of your current mortgage to help you save more. The service is 100% free of charge.

Real Estate Investment

Team and I'll assist you in selling or renting out your property quickly and effectively.

Professional Development Workshops

Enhance your sales and personal skills to achieve new professional goals.

Business and Marketing Support

Develop your business with our expert consulting services in business and marketing.

Yachting & Enduro Bikes

Join unforgettable sea excursions filled with leisure and adventures with your family or friends, or Explore Mountains with us on Enduro Bikes!

Experience

Education

I kicked off my journey with a degree in Management from the University of Economics, then dived into the world of Law and Finance.

Harvard Business School’s Leading with Finance program added another feather to my cap. But let’s be honest, I’m not one for stacking up certificates. From a young age, I’ve been all about learning through hands-on experience, hard graft, and relentless self-improvement.

For me, practice always trumps theory. While I’m eyeing an executive MBA in the U.S. or London to keep pushing my limits, my businesses, sports, and travel adventures are keeping me on my toes for now.

16 Years of Experience & Development

I had the incredible opportunity to be part of the growth of some of the top companies in the industry, working with exceptional people and inspiring entrepreneurs during my early years. As a financing manager, I collaborated with prominent developers like Echo Investment, EKO Park, Elara, among others.

My journey and commitment took me to top brands such as Hamilton May, and for more than 8 years, I’ve been developing my skills as a Head of the Financing Department at Private House Brokers and Property Group Poland. I’ve forged B2B partnerships with fantastic companies around the globe.

Today, I proudly collaborate with Lendi Group as part of Swiss Capital Group. I’m always learning, diving into books, attending trainings, and expanding my knowledge in areas that fascinate me, including economics, the stock market, leadership, law, psychology, and management. My passion for these subjects seamlessly aligns with my business pursuits.

Driven by Passion

By a happy accident, my passions turned into a thriving source of livelihood. I’ve always focused on areas that ignite a deep passion within me, allowing me to immerse myself in developing these fields for countless hours every day, year after year, without ever feeling bored. When I dive into something, I lose myself completely, and the world around me fades away. This intense focus has its pros and cons, as you can imagine, but it’s been a key driver of my development.

Values I Believe in

The core values that steer me in business are honesty, quality, trust, and a meticulous care for reputation. Building and nurturing strong relationships with employees, business partners, and customers is paramount. We weren’t born to work all our lives, but when we do, creating a fantastic atmosphere is essential. For me, the top priority is ensuring the team enjoys what we do and finds satisfaction in our work. When everyone is having fun and feels fulfilled, that’s when we truly succeed.

Privately

In my spare time, you’ll find me sailing the seas, addicted to alpine skiing, mountain biking, kitesurfing, embarking on adventure trips, or strumming my guitars. In short, I do everything I can to connect with nature and feel truly free. I’m always on the move because it keeps me creative and inspired. I cherish every moment with my loved ones. Life is too short and beautiful not to make the most of it. After all, we only get one visit to this incredible world.

Services

Financial Advisory (Free of charge)

Our mortgage and credit consulting offers expert guidance in navigating the world of mortgages and credit. We help you secure the right mortgage, improve your credit score, and make informed financial decisions. From selecting optimal loan options to enhancing creditworthiness, we provide personalized strategies to achieve your homeownership and financial goals.

Financial Intelligence

Discover financial peace of mind with our comprehensive Consulting service. Tailored exclusively for private individuals, our expert advisors guide you through a range of essential areas, from personalized budgeting and strategic investment planning to debt reduction, retirement preparation, and tax optimization. We provide a roadmap to achieve your financial aspirations, offering insights into estate planning, insurance coverage, and even charitable giving. With a focus on education and mindset, we empower you to make sound financial choices during life's transitions and challenges.

Property Investing

Comprehensive investment guidance: Expertly navigate the market with in-depth market analysis, financial insights for optimal cash flow, strategic property selection, risk management, and well-defined exit strategies. Whether it's your first transaction or you've been investing for a dozen years. Our professionals will guide you through the entire process from recognizing your needs, tailoring and customizing your individual real estate purchase concept to the smooth closing of the transaction. We also have access to off-market deals.

Development Workshops

Unlock your full potential with our comprehensive business and self-development consulting service. Our team of experts offers strategic guidance to businesses, optimizing operations, marketing, and financial management. For individuals, we provide personalized coaching, helping you enhance communication, confidence, and emotional intelligence. We offer a range of expert consulting services tailored to drive holistic growth.

Management Consulting

Empowering businesses to thrive with expert guidance in finance, HR, operations, marketing, and strategic leadership. Streamline processes, boost sales, and lead ethically – all in one place. In Operations Management, we streamline supply chains, improve processes, and maintain quality standards for enhanced efficiency. Boolster your brand, innovate products, and devise winning sales strategies to reach new heights. Finally, our Strategic Leadership ensures ethical responsibility, effective planning, and cohesive team management, charting the course for your success.

Leisure, Trips, Sports & Adventures

Welcome to Quick Trip Travel Agency, where your wanderlust meets its match! Our mission is simple: to make your travel dreams a reality, with a dash of excitement and a pinch of magic. Whether you're seeking an adrenaline-fueled adventure, a relaxing beach escape, or a cultural immersion like no other, our expert team of travel sorcerers will craft the perfect journey just for you. Get ready to embark on unforgettable expeditions and discover the world in all its breathtaking glory. Fasten your seatbelts, adventurers - with Quick Trip, the world is your playground!"

Awesome Clients

Basic

- Budgeting and Saving

- Debt Management

- Principles of finance and economics

- Tax & Risk Management

- Investing and Wealth Management

Standard

- Budgeting and Saving

- Debt Management

- Principles of finance and economics

- Tax & Risk Management

- Investing and Wealth Management

Premium

- Budgeting and Saving

- Debt Management

- Principles of finance and economics

- Tax & Risk Management

- Investing and Wealth Management

Property Investing

Basic

- Financing and Cash Flow

- Exit Strategy

- Property Selection

- Risk Management

- Market Analysis

Standard

- Financing and Cash Flow

- Exit Strategy

- Property Selection

- Risk Management

- Market Analysis

Premium

- Financing

- Exit Strategy

- Property Selection

- Risk Management

- Market Analysis

Development Workshops

Basic

- Entrepreneurship

- Your Strengths and Self-Presence

- Emotional Intelligence

- Sales Workshops

- Comprehensive Business Consulting

Standard

- Entrepreneurship

- Your Strengths and Self-Presence

- Emotional Intelligence

- Sales Workshops

- Comprehensive Business Consulting

Premium

- Entrepreneurship

- Your Strengths and Self-Presence

- Emotional Intelligence

- Sales Workshops

- Comprehensive Business Consulting

Management Consulting

Basic

- Operations Management

- Human Resource Management

- Marketing and Sales

- Strategic Leadership

- Financial Management

Premium

- Operations Management

- Human Resource Management

- Marketing and Sales

- Strategic Leadership

- Financial Management

Premium

- Operations Management

- Human Resource Management

- Marketing and Sales

- Strategic Leadership

- Financial Management

Financial Intelligence

Check Packages

Real Estate Investing

Check Packages

Financial Intelligence

Check Packages

Financial Intelligence

Check Packages

Front Title

This is front side content.

Back Title

This is back side content.

#1 Financial Advisory

first step into mortgages & financial intelligenceFREE

#2 Smart all round private consulting

comprehensive meeting on financial intelligence$199

#3 beginner's investor package

Advanced guide$499

#4 Business & professional consulting

your company or personal brand development$999

#5 sales & management workshops

skills masterclass$1499

#6 experienced investor's package pro

Ultimate know-how & contacts$2999

Schedule a Meeting

Jacob Adam Pajak

Founder & CEO of Harveo GroupCall or fill the form. We'll assess your situation immediately. You will get an individually structured action plan according to your situation. Mortgage support is free of charge.

Phone: +48 12 352 12 12Stay updated

Save time and money. All the essentials covering Financial Intelligence in one place. Tailored especifically for you!

Thank you!

We confirm correct enrollment.

Guide for Expats in Poland

Refinancing your mortgage – how to cut your % interest rate and save a lot of money right now?

Refinancing your mortgage (transferring your loan to another bank) can

Refinancing your mortgage – how to cut your % interest rate and save a lot of money right now?

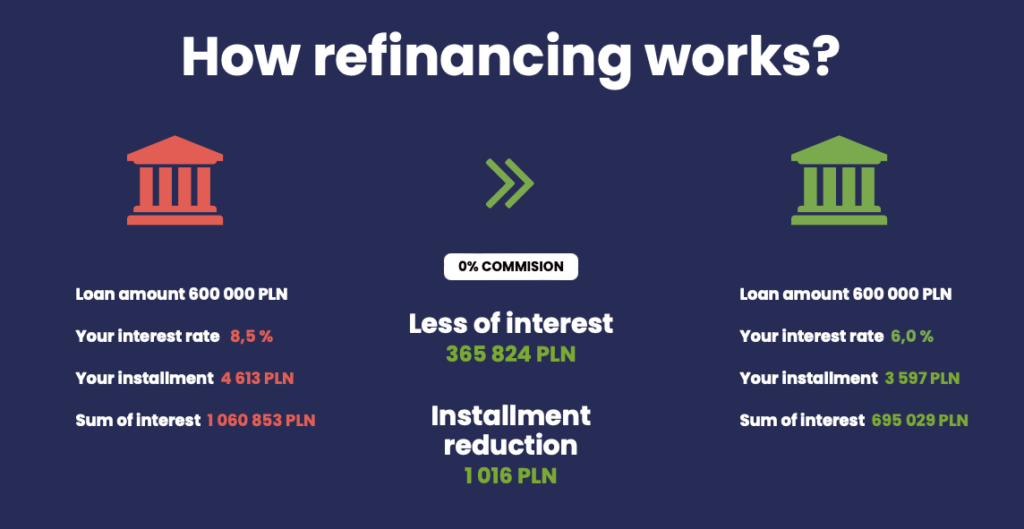

Refinancing your mortgage (transferring your loan to another bank) can bring significant financial benefits for your wallet!

Remember:

- You do not have to wait until 5 years of your currently signed fixed rate will expire in your current bank. You can refinance your loan literally the day after disbursement of your old loan.

- The whole process, from consultations, analysis, processing the refinancing into a new more profitable bank for you and even supporting you in a bank’s branch – it’s 100% free of charge! You pay us literally nothing, and get precisely 1:1 the same offer as if you would visit for example ING, Millennium, mBank’s etc. branches by yourself. The banks have special marketing funds to reward us from successful transfers. So it’s a full win – win for either you and us.

If you have recently signed a mortgage contract with a fixed interest rate for 5 years, refinancing will help you to take advantage of reducing your high interest % rate, monthly payments and the total cost of the loan. There’s no rocket science – we already helped over a hundred of our clients in 2023/2024 since inflation escalated and bank’s rates went wildly skyrocketing.

Even though this process is fast and simple, it requires analysis and understanding of a few key factors. In the following article, I explain when it is worth considering refinancing your mortgage, how the process works, and what benefits it can bring. If you are considering transferring your loan, this guide is for you!

What mortgage refinancing actually is?

Mortgage refinancing involves transferring an existing loan to another bank to obtain better financial terms. This can include:

- Lowering monthly payments – by renegotiating the loan terms, you can reduce the amount of your monthly payments.

- Extending the loan term – a longer repayment period can lower the monthly payment, which is beneficial for your household budget.

- Reducing the total cost of the loan – lower interest rates or margins can significantly decrease the total cost of the loan.

When should you consider refinancing your mortgage?

Refinancing your mortgage can be beneficial in several key situations:

- Changing market conditions – banks regularly update their offers, which may result in better loan conditions than those in your current agreement.

- Payment difficulties – if your mortgage payment becomes too challenging for your household budget, refinancing can help lower the monthly payment by extending the repayment period.

- Consolidating debts – if you have multiple financial obligations, transferring your mortgage can simplify financial management by consolidating all debts into one loan.

Common reasons for refinancing a mortgage

Borrowers often decide to refinance for the following reasons:

How to transfer a mortgage to another bank?

- High fixed rate signed for 5 years period – If your current mortgage has a high fixed interest rate, refinancing will help you take advantage of lower rates available in the market, reducing your monthly payments and the total cost of the loan. Remember, you do not have to wait until 5 years of signed fixed rate will expire in your current bank. You can refinance your loan literally day after disbursement of your old loan.

- Low own contribution payment when signed the mortgage – the original loan may have been more expensive due to a low own contribution (down payment). Refinancing can provide better terms thanks to improved creditworthiness.

- High margin – the loan margin is a fixed component of the interest rate throughout the loan period. A high margin can be a significant burden on the household budget, so reducing it through refinancing can bring additional savings.

The process of transferring a mortgage consists of several steps:

- Analyze offers with a mortgage expert – compare the available offers from banks, considering all additional costs such as fees and commissions.

- Understand all costs – the mortgage expert will check if the early repayment of the current loan involves additional costs, such as early repayment fees, notary fees, property valuation costs, and court fees.

- Submit a loan application – after selecting a specific offer, the expert will help you submit an application for refinancing at the new bank.

- Repay the debt at the current bank – once the new refinancing loan is granted, the funds from this loan will be used to repay the existing obligation.

What documents are needed to refinance a mortgage?

When transferring a loan to another bank, you need to prepare:

- The loan agreement from the previous bank.

- Documents confirming the current balance of the debt.

- Property-related documents, e.g., an excerpt from the land and mortgage register along with the property valuation.

- Proof of income.

- Bank account statements (e.g., for the last 3-6-12 months).

Costs of refinancing a mortgage

Refinancing costs can include:

- Cost of property valuation – banks vary in their charges for property valuation. Can vary from ~ 350 to 1200 PLN

- Early repayment fee – this may be charged for loans with variable interest rates signed a few years ago and being repaid before a specified time (specified in your contract), however in almost every case it’a round 0% from the day one, especially on fixed 5 years contracts.

- Fee for granting a refinancing loan – in every offer we have, there’s round 0% of entry fee / commission.

- Court fees – related to changes in entries in the land and mortgage register, what we usually help you with. The cost is about ~ 350 PLN to pay at once for administration fee.

To sum up, in 99% of cases we guide our customers through, the total sum of refinancing costs are around 1000 PLN as sum of property valuation and court mortgage fee. It means, usually you benefit and cover that already after first month of way lower installment reduced on the new mortgage you will got. If your old property valuation is not older than 12 months, you probably won’t be able to pay for w new one – depends in the banks where we’ll do the refinance.

Creditworthiness matters

Refinancing a mortgage involves taking out a new loan. Banks will verify the borrower’s repayment history and creditworthiness. Therefore, it is worth acting quickly when problems with repaying the current loan arise.

Is refinancing your mortgage worth it?

Absolutely! Lowering monthly payments, reducing the total cost of the loan, and improving loan terms are just a few potential benefits. Additionally, it is essential to carefully analyze the refinancing of the mortgage considering all costs and benefits. Contact our experts to get professional help and find the best solution for your financial situation.

Remember:

- You do not have to wait until 5 years of your currently signed fixed rate will expire in your current bank. You can refinance your loan literally day after disbursement of your old loan.

- The whole process, from consultations, analysis, processing the refinancing into a new more profitable bank for you and even supporting you in a bank’s branch – it’s 100% free of charge! You pay us literally nothing, and getting anyway precisely 1:1 the same offer like if you would visit for example ING, Millennium, mBank’s etc. branches by yourself. The banks have a special marketing funds to gratificate us from successful transfers. So it’s a full win – win for either you and us.

Contact Us

If you are considering refinancing your mortgage and want to learn more about the possibilities offered by current market conditions, contact us today. Our experts will help you analyze the available options and choose the best offer. Click here to speak with our mortgage expert.

Call us on +48 12 352 12 12 or fill out the contact form on contact page to schedule a free consultation. We are here to help you!

Refinancing your mortgage can be a crucial step towards improving your financial situation. Take advantage of our knowledge and experience to find the most beneficial solution for yourself.

Join our Expats Community

Subscribe my Channels

Stay updated

Save time and money. All the essentials covering Financial Intelligence in one place. Tailored especifically for you!

Thank you!

We confirm correct enrollment.

🎥 🔴 Downpayment Options: 10% vs 20%+ for Mortgage Loans in Poland – Accessibility & Benefits

We have prepared a series of recordings for you. We

🎥 🔴 Downpayment Options: 10% vs 20%+ for Mortgage Loans in Poland – Accessibility & Benefits

We have prepared a series of recordings for you.

We want you to come to the meeting with an outline in your head of the area we are going to cover. You will find on our platform videos that address the most important, fundamental issues of taking out a mortgage. Some of them relate more to you when it comes to, for example, the issue of creditworthiness itself, some of them develop other threads, less universal, but they should also be exhausted at the very beginning. We want you to have a certain foundation when coming to the meeting so that it is as productive as possible for you – we respect your time. We invite you to watch and possibly ask questions already at the meeting.

Down Payment Segments

- 10% down payment – having a 10% down payment opens up mortgage opportunities but often comes with stricter conditions and higher costs. Many banks are cautious about lending with a lower down payment due to increased risk. To mitigate this risk, banks may require:

- Low down payment insurance – this can be a separate policy paid upfront or incorporated into the loan margin, which increases the overall cost until the equity reaches 20%.

- Higher margins – banks may offer higher interest rates to compensate for the higher risk associated with lower down payments.

- Limited bank options – not all banks will accept a 10% down payment. Approximately half of the banks in Poland might approve such loans, often with additional conditions.

- 20% down payment and higher – a down payment of 20% or more is considered standard and minimizes the perceived risk for the bank. This generally results in:

- Better loan offers – with a 20% down payment, you are likely to receive better interest rates and terms.

- Compliance with KNF recommendations – the Polish Financial Supervision Authority (KNF) recommends a 20% down payment, making it easier to meet bank criteria.

- Flexibility – higher down payments beyond 20% do not significantly change the loan terms but improve your equity and reduce the loan amount needed.

Loan-to-Value Ratio (LTV)

LTV is a critical factor in mortgage lending. It represents the ratio of the loan amount to the appraised value of the property:

- Example calculation – if the property value is PLN 1,000,000 and you have a 20% down payment, you can borrow up to PLN 800,000, resulting in an LTV of 80%. For a 10% down payment, you can borrow up to PLN 900,000, resulting in an LTV of 90%.

- Impact on loan approval – lower LTV ratios (higher down payments) are preferable as they reduce the bank’s risk. Higher LTV ratios (lower down payments) may require additional measures like insurance.

Refinancing and LTV Adjustments

Changes in property value and loan repayments can adjust your LTV ratio:

Repayments and overpayments – making regular repayments or additional overpayments reduces the loan amount, thereby decreasing the LTV ratio. For example, paying down the principal amount can shift your LTV from 90% to 80%.

Increasing property value – if the property value increases over time, your LTV ratio decreases, improving your loan conditions. For instance, if the property value rises due to market conditions, the increased equity can lower your LTV ratio.

Why you should consult your situation with our experts?

Every financial situation is unique, which is why an individual approach to choosing a mortgage loan is so important. Our assumptions are only a simulation, and your conditions may differ. That’s why we encourage you to contact our experts who will:

- Analyze your individual financial situation

- Find the best loan offers available on the market

- Help negotiate with the bank

- Provide support at every stage of the loan process

By working with us, you can be sure that the selected mortgage loan will be perfectly tailored to your financial situation and future plans.

Contact Us

Consult your situation with our Experts. Take advantage of our knowledge and 16 years of experience to make the best financial decision. Remember, working with us is completely free of charge!

Call us on +48 12 352 12 12 or fill out the contact form on contact page to schedule a free consultation. We are here to help you!

Join our Expats Community

Subscribe my Channels

Stay updated

Save time and money. All the essentials covering Financial Intelligence in one place. Tailored especifically for you!

Thank you!

We confirm correct enrollment.

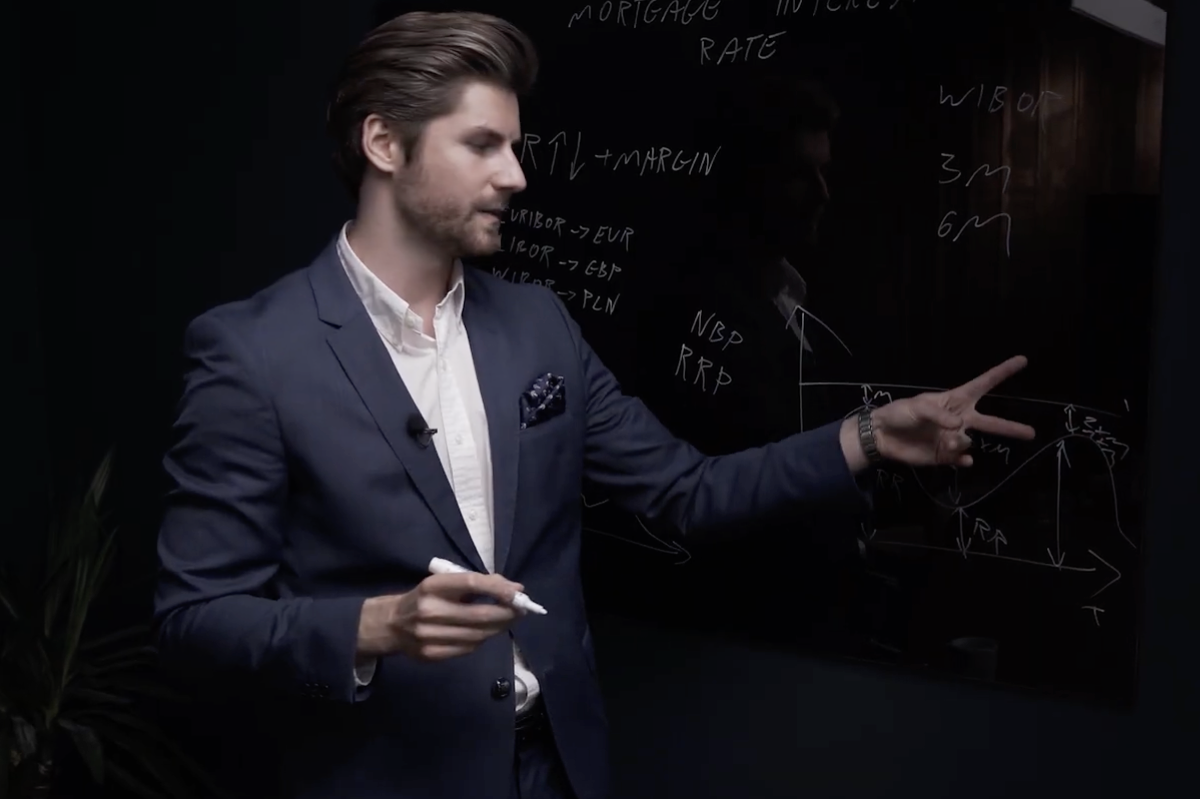

🎥 🔴 Understanding Mortgage Interest Rates in Poland: Margins, Reference Rates, and Economic Factors

We have prepared a series of recordings for you. We

🎥 🔴 Understanding Mortgage Interest Rates in Poland: Margins, Reference Rates, and Economic Factors

We have prepared a series of recordings for you.

We want you to come to the meeting with an outline in your head of the area we are going to cover. You will find on our platform videos that address the most important, fundamental issues of taking out a mortgage. Some of them relate more to you when it comes to, for example, the issue of creditworthiness itself, some of them develop other threads, less universal, but they should also be exhausted at the very beginning. We want you to have a certain foundation when coming to the meeting so that it is as productive as possible for you – we respect your time. We invite you to watch and possibly ask questions already at the meeting.

Bank Margins

Bank margins are a significant part of the mortgage interest rate. This is essentially the profit that the bank aims to make on the loan they provide. Here’s what you need to know about bank margins:

- Fixed vs. Variable Margins – some banks offer fixed margins, meaning the margin remains the same throughout the loan term. Others offer variable margins that can change based on market conditions or your credit profile.

- Risk – the bank adds a risk bonus to the interest rate based on creditworthiness, employment stability and other risk factors. Higher perceived risk results in a higher margin.

Reference Rates

Reference rates, also known as base rates, are another crucial element in determining mortgage interest rates. In Poland, the most common reference rates are the WIBOR (Warsaw Interbank Offered Rate) for loans in PLN, and EURIBOR (Euro Interbank Offered Rate) for loans in EUR. Here’s how they work:

- WIBOR – this is the rate at which banks lend to each other in the Polish market. It fluctuates based on supply and demand for funds and is influenced by monetary policy and economic conditions.

- EURIBOR – this rate applies to loans denominated in euros and is influenced by the European Central Bank’s monetary policy and broader economic conditions in the Eurozone.

- Impact on Mortgages – your mortgage interest rate is often expressed as the reference rate plus the bank’s margin. For example, if the WIBOR is 1.5% and the bank’s margin is 2%, your mortgage interest rate will be 3.5%.

The Economy in Poland

The broader economic context in Poland also plays a significant role in shaping mortgage interest rates. Here’s how various economic factors come into play:

- Inflation – higher inflation typically leads to higher interest rates as the central bank raises rates to control inflation. Conversely, lower inflation can result in lower interest rates.

- Monetary Policy – the National Bank of Poland (NBP) sets the base interest rates for the economy. Changes in the NBP’s policy rates directly influence the reference rates like WIBOR.

- Economic Growth – strong economic growth can lead to higher interest rates as demand for credit increases and the central bank acts to prevent the economy from overheating. In contrast, slower growth or a recession can lead to lower interest rates as the central bank aims to stimulate borrowing and investment.

- International Influences: Global economic conditions and policies of major central banks (like the ECB and the Federal Reserve) can also impact Polish interest rates, particularly if there are significant movements in global interest rates or economic trends.

Why you should consult your situation with our experts?

Every financial situation is unique, which is why an individual approach to choosing a mortgage loan is so important. Our assumptions are only a simulation, and your conditions may differ. That’s why we encourage you to contact our experts who will:

- Analyze your individual financial situation

- Find the best loan offers available on the market

- Help negotiate with the bank

- Provide support at every stage of the loan process

By working with us, you can be sure that the selected mortgage loan will be perfectly tailored to your financial situation and future plans.

Contact Us

Consult your situation with our Experts. Take advantage of our knowledge and 16 years of experience to make the best financial decision. Remember, working with us is completely free of charge!

Call us on +48 12 352 12 12 or fill out the contact form on contact page to schedule a free consultation. We are here to help you!

Join our Expats Community

Subscribe my Channels

Stay updated

Save time and money. All the essentials covering Financial Intelligence in one place. Tailored especifically for you!

Thank you!

We confirm correct enrollment.

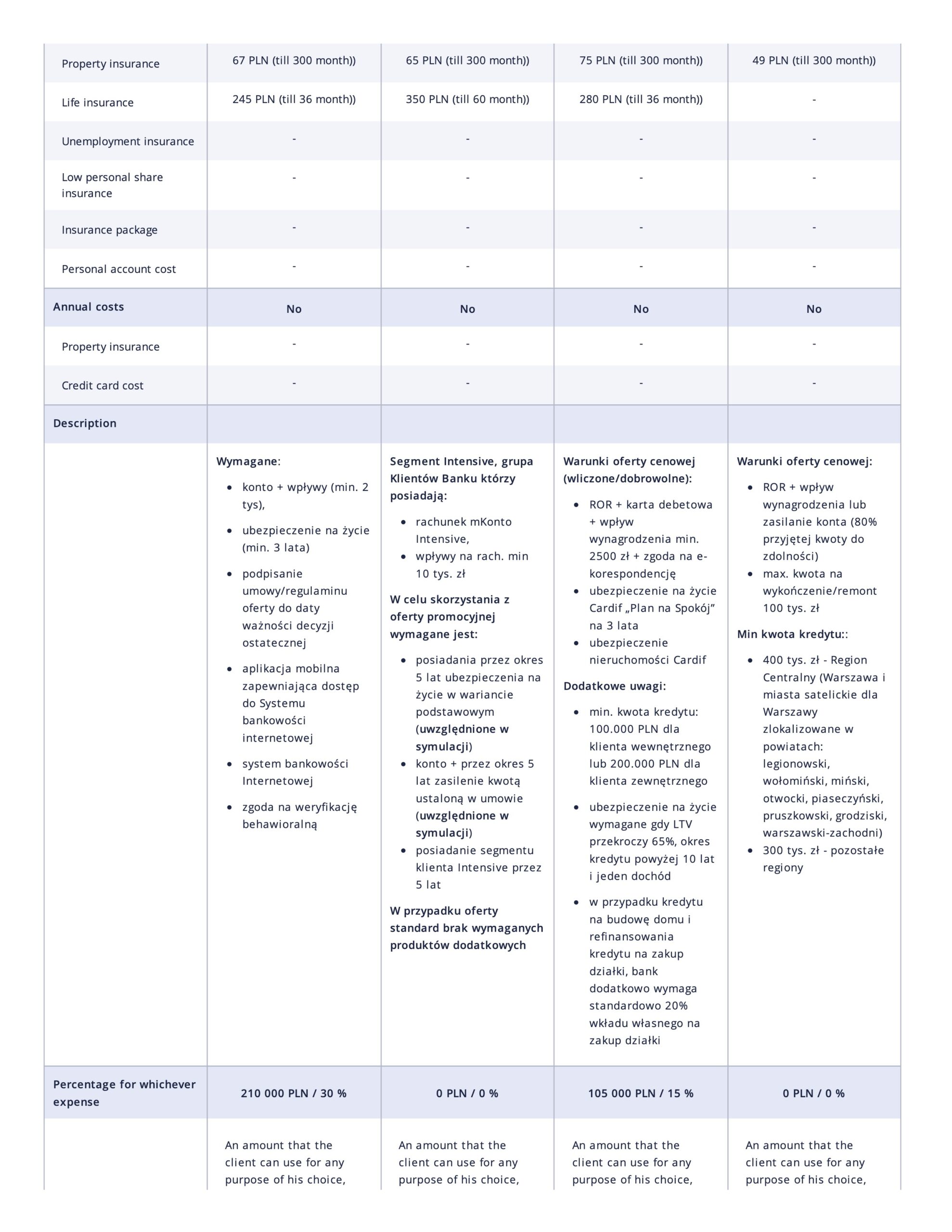

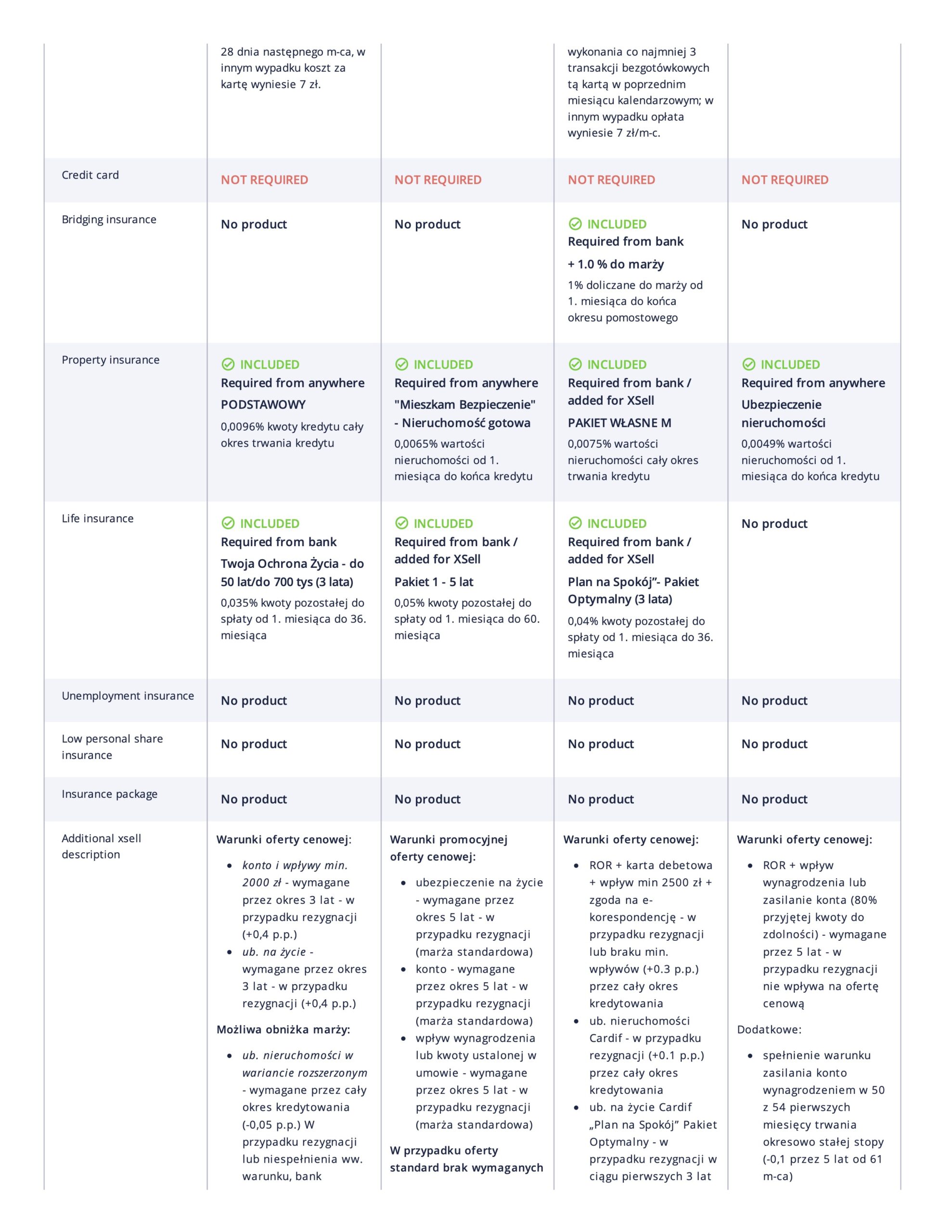

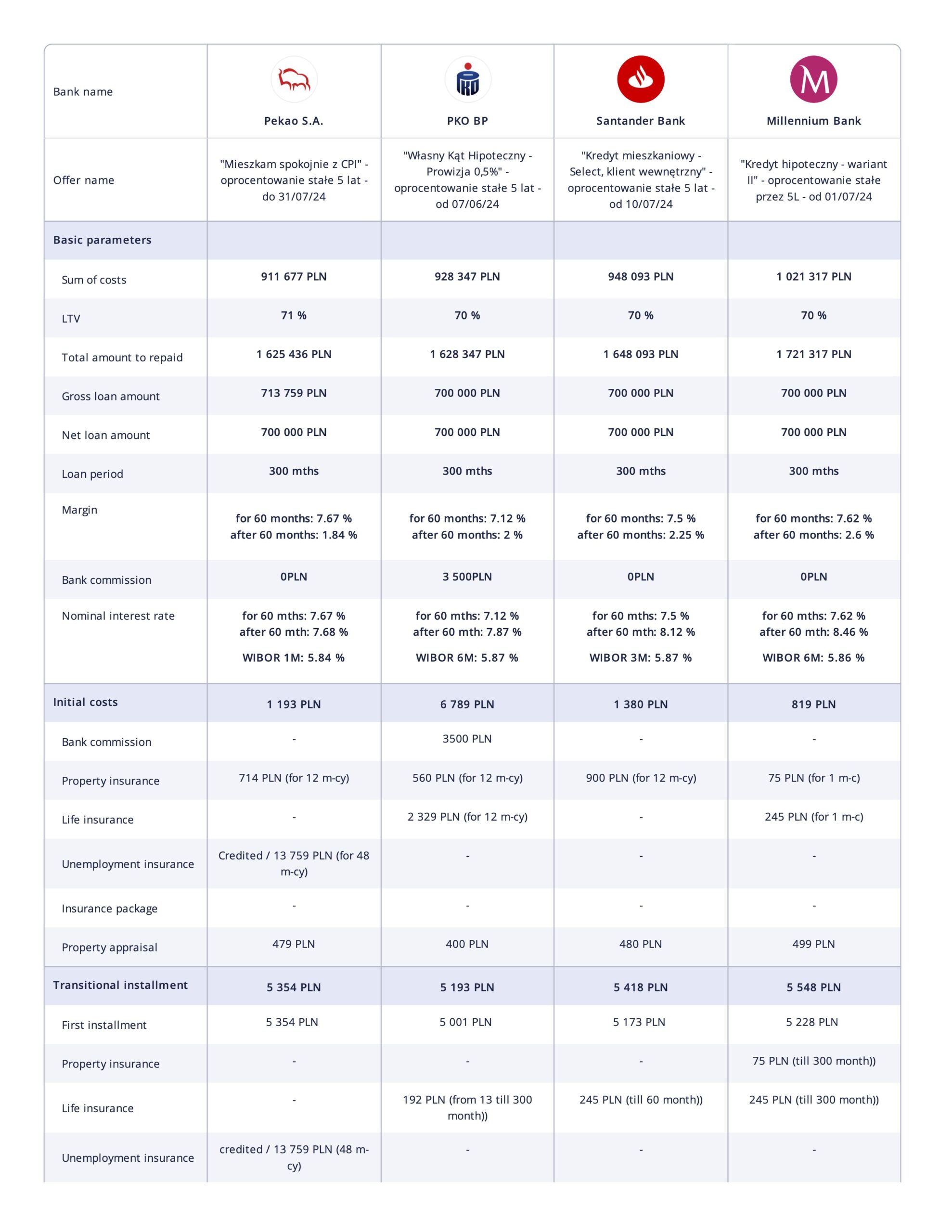

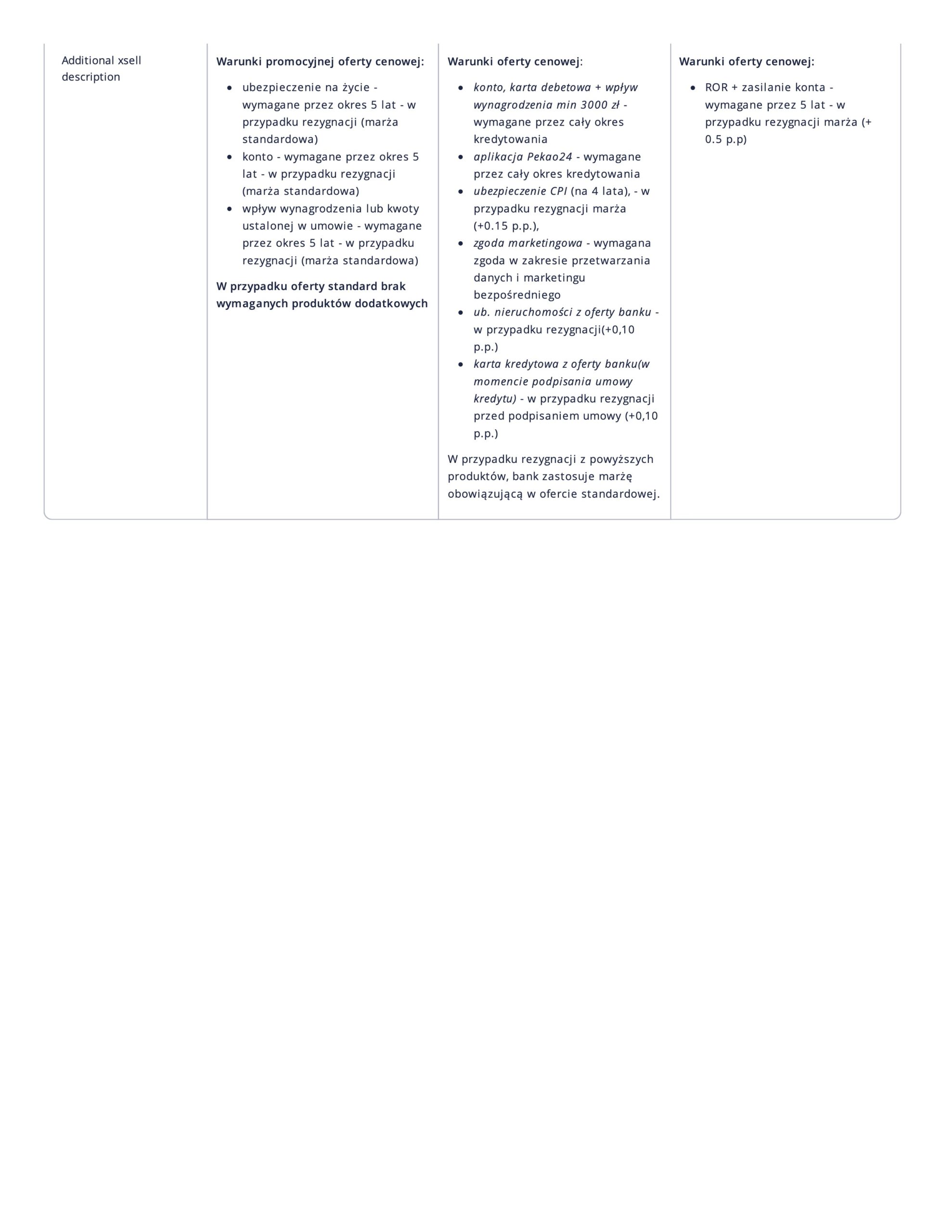

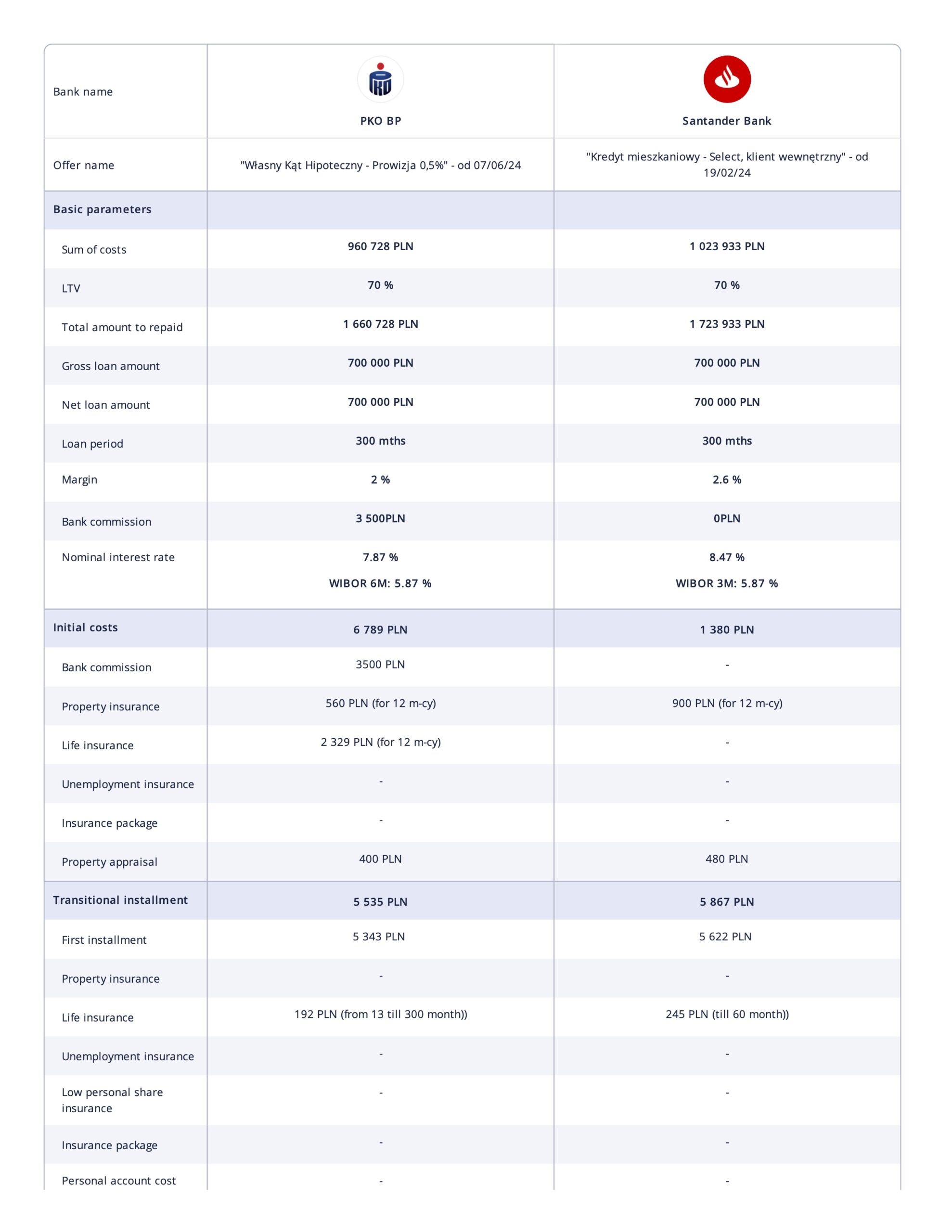

Fixed rate Mortgage – Ranking July 2024

Considering the best fixed rate mortgage for your needs? Check

Fixed rate Mortgage – Ranking July 2024

Hi! If you’re looking for the best mortgage, you’ve come to the right place. We have prepared for you the July ranking of the best mortgage offers for 25 years, for the amount of PLN 700,000 with 30% of own contribution. In our list you will find offers with the lowest interest rates, favourable repayment conditions and minimal additional costs.

Why you should consult your situation with our experts?

Every financial situation is unique, which is why an individual approach to choosing a mortgage loan is so important. Our assumptions are only a simulation, and your conditions may differ. That’s why we encourage you to contact our experts who will:

- Analyze your individual financial situation

- Find the best loan offers available on the market

- Help negotiate with the bank

- Provide support at every stage of the loan process

By working with us, you can be sure that the selected mortgage loan will be perfectly tailored to your financial situation and future plans.

Contact Us

Consult your situation with our Experts. Take advantage of our knowledge and 16 years of experience to make the best financial decision. Remember, working with us is completely free of charge!

Call us on +48 12 352 12 12 or fill out the contact form on contact page to schedule a free consultation. We are here to help you!

Why mortgage loan rankings can vary?

Mortgage loan rankings can differ for several key reasons. Each bank offers different terms, promotions, and has an individual approach to customers. Various rankings may take into account different factors such as:

- Insurance costs

- Fees and additional charges

- Repayment flexibility

- Promotions and bonuses for new customers

Our list is based on the assumption of a 25-year mortgage loan for the amount of 700,000 PLN with a 30% down payment. However, every financial situation is unique, and the final offer from the bank may vary depending on individual conditions and needs.

Why you should consult your situation with our experts?

Every financial situation is unique, which is why an individual approach to choosing a mortgage loan is so important. Our assumptions are only a simulation, and your conditions may differ. That’s why we encourage you to contact our experts who will:

- Analyze your individual financial situation

- Find the best loan offers available on the market

- Help negotiate with the bank

- Provide support at every stage of the loan process

By working with us, you can be sure that the selected mortgage loan will be perfectly tailored to your financial situation and future plans.

Contact Us

Consult your situation with our Experts. Take advantage of our knowledge and 16 years of experience to make the best financial decision. Remember, working with us is completely free of charge!

Call us on +48 12 352 12 12 or fill out the contact form on contact page to schedule a free consultation. We are here to help you!

Join our Expats Community

Subscribe my Channels

Stay updated

Save time and money. All the essentials covering Financial Intelligence in one place. Tailored especifically for you!

Thank you!

We confirm correct enrollment.

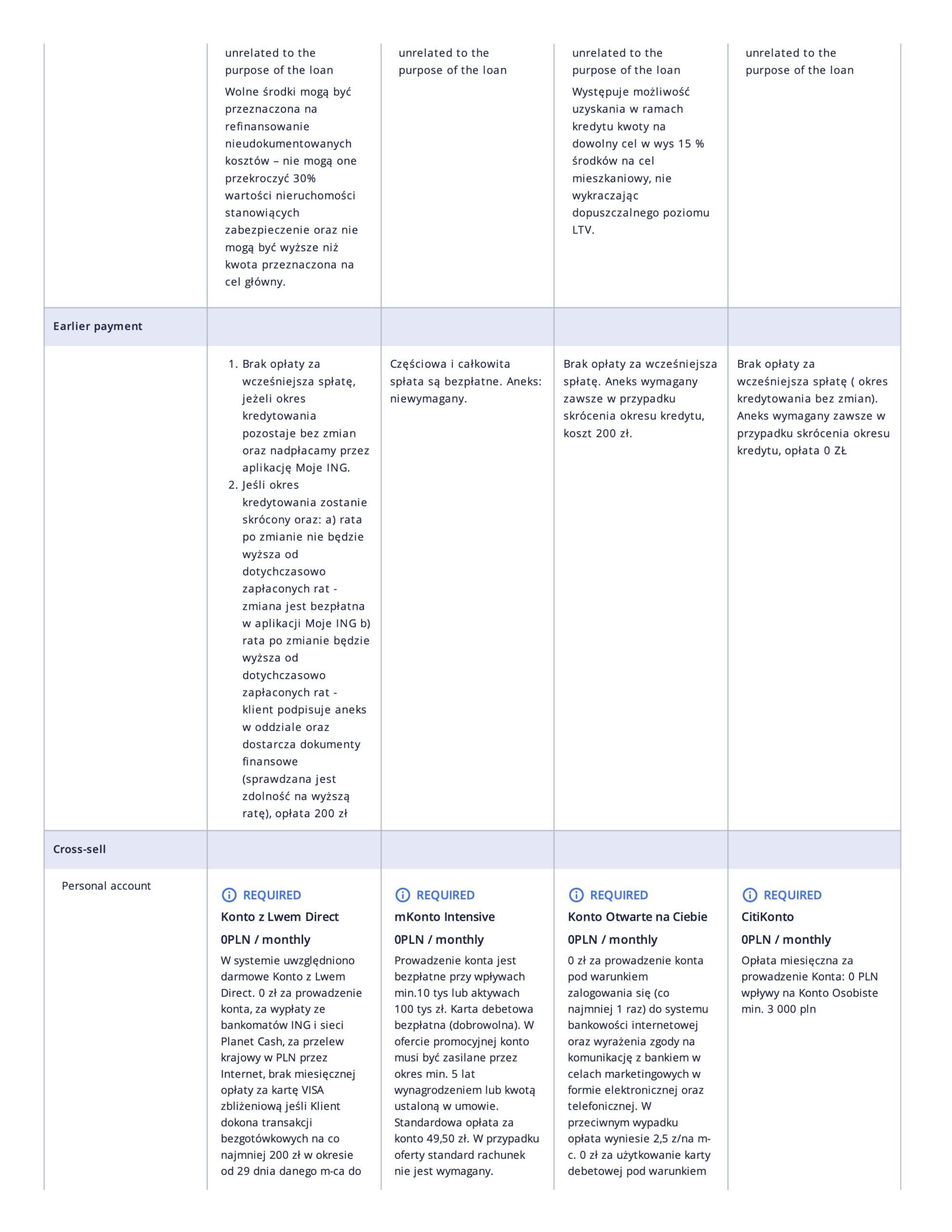

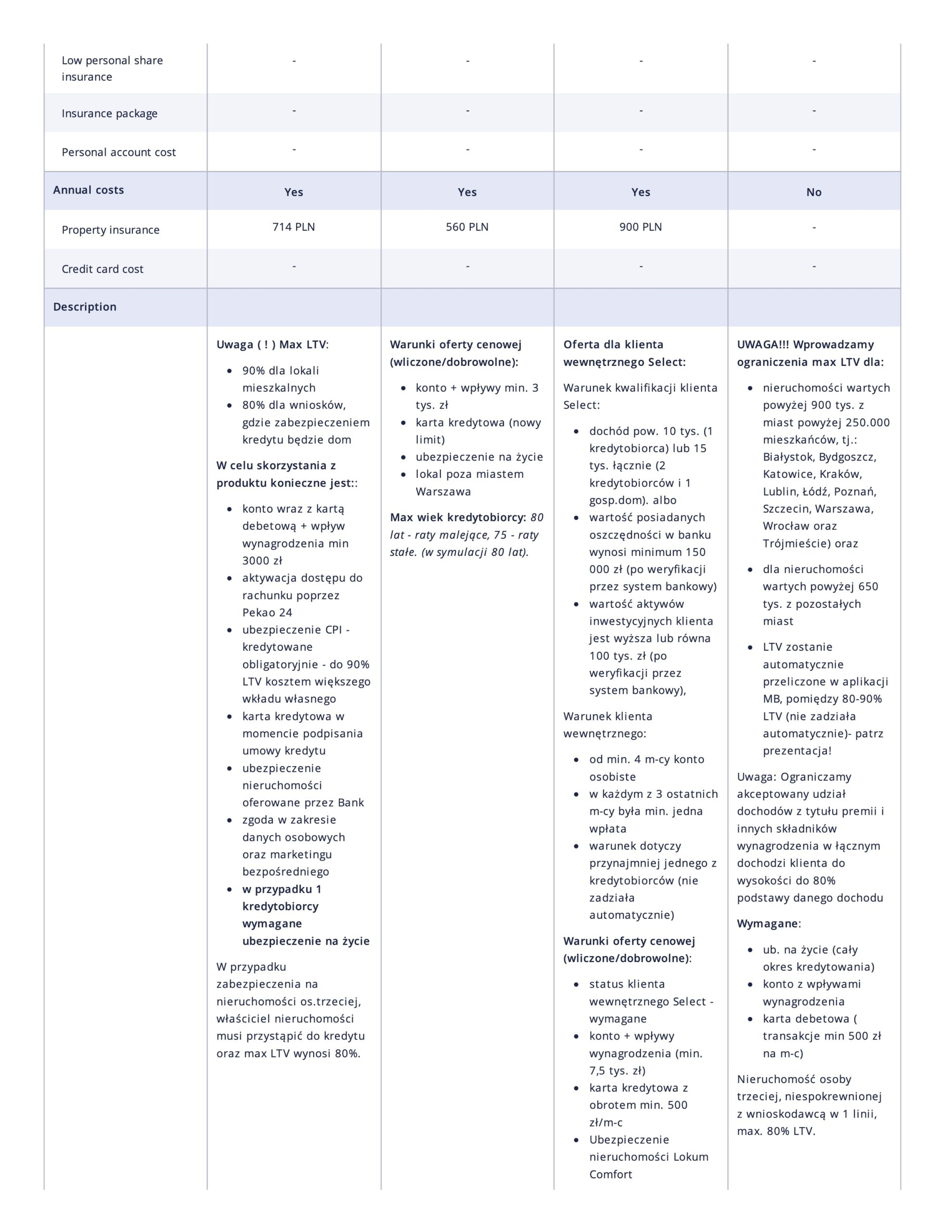

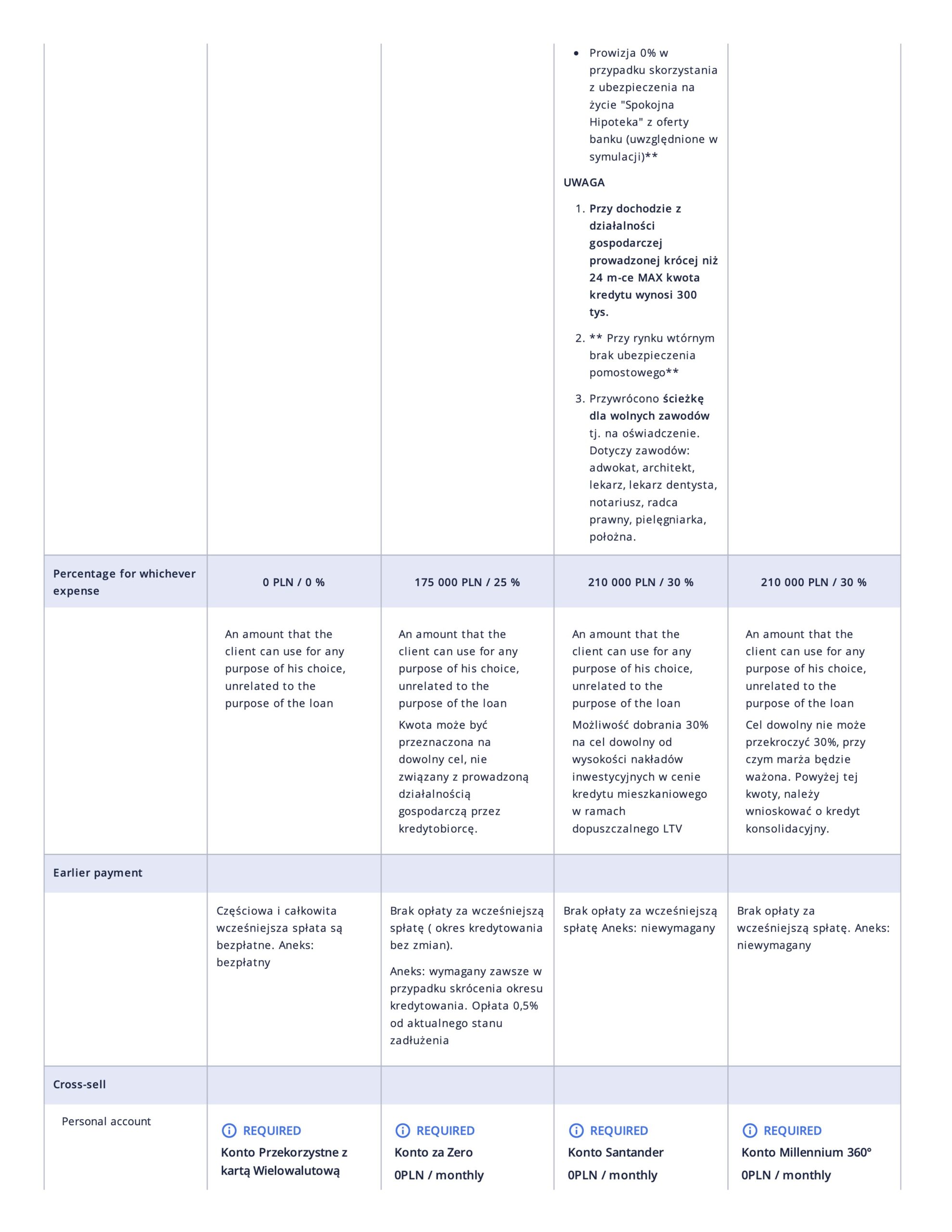

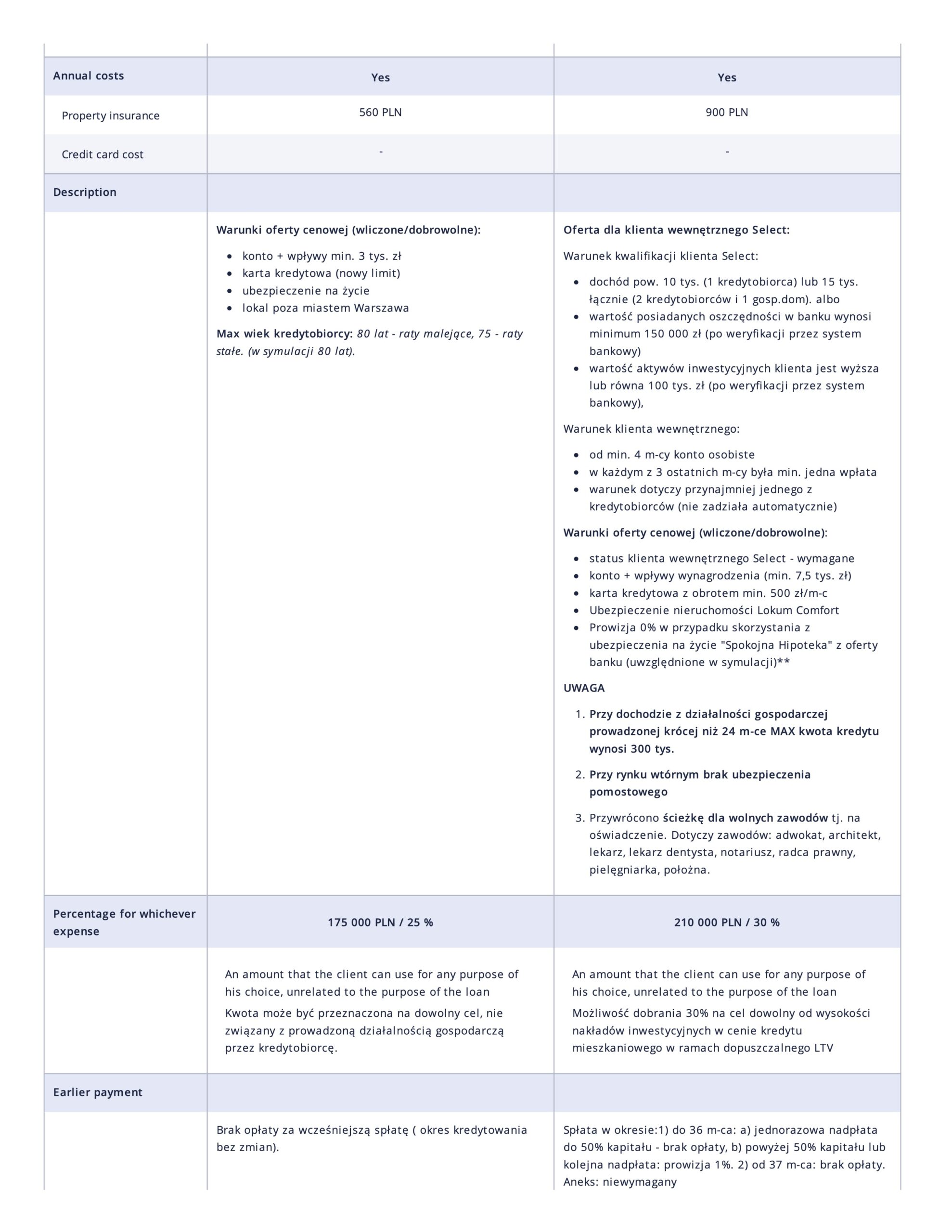

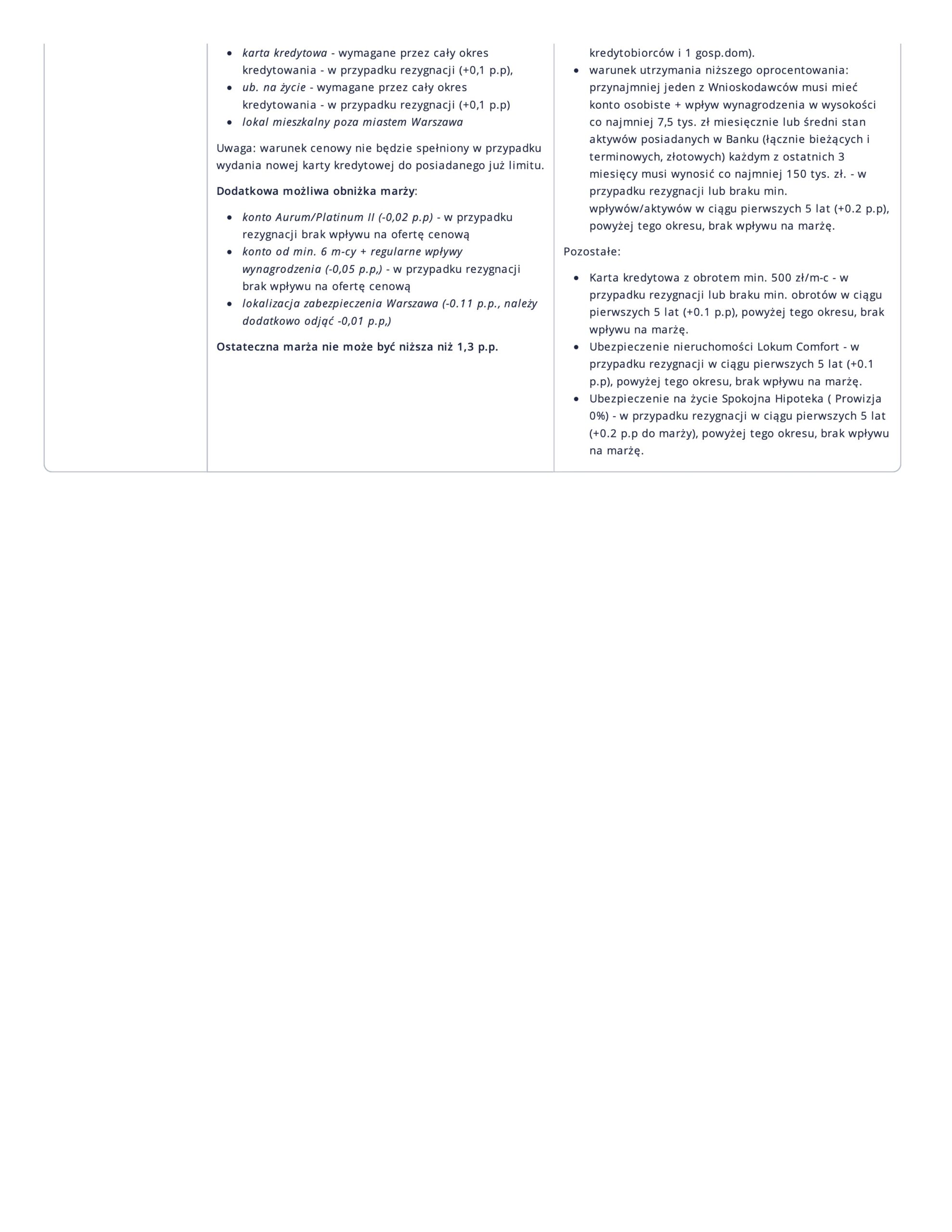

Variable rate Mortgages – Ranking July 2024

Considering a variable rate mortgage? Check out ranking for July

Variable rate Mortgages – Ranking July 2024

Hi! If you’re looking for the best mortgage, you’ve come to the right place. I have prepared for you the July ranking of the best mortgage offers for 25 years, for the amount of PLN 700,000 with 30% of own contribution. In the below comparison you will find offers with the lowest interest rates, favorable repayment conditions and minimal additional costs.

Why you should consult your situation with our experts?

Every financial situation is unique, which is why an individual approach to choosing a mortgage loan is so important. The assumptions are only a simulation, and your conditions may differ. That’s why I encourage you to contact our Expert Team who will:

- Analyze your individual financial situation

- Find the best loan offers available on the market

- Help negotiate with the bank

- Provide support at every stage of the loan process

By working with us, you can be sure that the selected mortgage loan will be perfectly tailored to your financial situation and future plans.

Contact Us

Consult your situation with our Experts. Take advantage of our knowledge and 16 years of experience to make the best financial decision. Remember, working with us is completely free of charge!

Call us on +48 12 352 12 12 or fill out the contact form on contact page to schedule a free consultation. We are here to help you!

Why mortgage loan rankings can vary?

Mortgage loan rankings can differ for several key reasons. Each bank offers different terms, promotions, and has an individual approach to customers. Various rankings may take into account different factors such as:

- Insurance costs

- Fees and additional charges

- Repayment flexibility

- Promotions and bonuses for new customers

The list is based on the assumption of a 25-year mortgage loan for the amount of 700,000 PLN with a 30% down payment. However, every financial situation is unique, and the final offer from the bank may vary depending on individual conditions and needs.

Why you should consult your situation with our experts?

Every financial situation is unique, which is why an individual approach to choosing a mortgage loan is so important. The assumptions are only a simulation, and your conditions may differ. That’s why I encourage you to contact our Expert Team who will:

- Analyze your individual financial situation

- Find the best loan offers available on the market

- Help negotiate with the bank

- Provide support at every stage of the loan process

By working with us, you can be sure that the selected mortgage loan will be perfectly tailored to your financial situation and future plans.

Contact Us

Consult your situation with our Experts. Take advantage of our knowledge and 16 years of experience to make the best financial decision. Remember, working with us is completely free of charge!

Call us on +48 12 352 12 12 or fill out the contact form on contact page to schedule a free consultation. We are here to help you!

Join our Expats Community

Subscribe my Channels

Stay updated

Save time and money. All the essentials covering Financial Intelligence in one place. Tailored especifically for you!

Thank you!

We confirm correct enrollment.

Mortgage for foreigners in Poland – complete guide

Thinking about buying property in Poland as a foreigner? Learn

Mortgage for foreigners in Poland – complete guide

Thinking about buying property in Poland as a foreigner? Learn how to obtain a mortgage, what the requirements are, and what documents you will need!

Conditions for obtaining a mortgage for foreigners in Poland

PESEL number and registration:

To apply for a mortgage, a foreigner must have a PESEL number and be registered in Poland. Although the registration obligation was abolished on January 1, 2016, confirming residence in Poland is still important.

Creditworthiness:

- Employment form – those with an employment contract for an indefinite period have the best chances of getting a mortgage.

- Financial situation – banks assess the applicant’s income compared to monthly expenses to ensure they can repay the loan.

- Credit history – a good credit history without any overdue payments is crucial. Banks check the credit history in Poland and the applicant’s home country.

- Personal situation – age, number of dependents, marital status, and education are considered when assessing creditworthiness.

Residence Card and Other Documents:

- Residence card – a valid temporary or permanent residence card or EU resident status is required. Banks have different requirements regarding the validity period of the card.

- Identity document (e.g., passport).

- Employment and income certificate – a certificate from the employer and a PIT return for the previous year.

- Bank account statement – confirming the income.

- Documents related to the mortgaged property.

Mortgage and down payment requirements

According to Recommendation S issued by the Polish Financial Supervision Authority (KNF), banks can finance up to 80% of the property’s value. In exceptional cases, financing up to 90% is possible, but the excess must be additionally secured (e.g., low down payment insurance, bank account fund block, pledge on government bonds).

Mortgage without a residence card – is it possible?

It is now possible to obtain a mortgage without a residence card from one of the banks that accepts the PESEL number as a sufficient identity document.

How do banks assess the creditworthiness of foreigners?

Banks assess creditworthiness by verifying identity and income sources. The credit history is checked in Poland (BIK) and the applicant’s home country (e.g., International Bureau of Credit Histories).

Documents required for a mortgage for foreigners

- Copy of the identity document (not always).

- Employment and income certificate.

- PIT return for the previous year.

- Bank account statement confirming income.

- Documents related to the mortgaged property.

- All documents must be translated into Polish by a sworn translator.

- Waiting time for a mortgage decision

The bank has 21 days to issue a mortgage decision from the date of submitting a complete application. The average waiting time for a decision is about 2 weeks.

Contact Us

Consult your situation with our Experts. Take advantage of our knowledge and 16 years of experience to make the best financial decision. Remember, working with us is completely free of charge!

Call us on +48 12 352 12 12 or fill out the contact form on contact page to schedule a free consultation. We are here to help you!

Join our Expats Community

Subscribe my Channels

Stay updated

Save time and money. All the essentials covering Financial Intelligence in one place. Tailored especifically for you!

Thank you!

We confirm correct enrollment.